north carolina sales tax rate on food

A customer buys a toothbrush a bag of candy and a loaf of bread. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

How To Register File Taxes Online In North Carolina

The North Carolina sales tax rate is 475 percent but the total tax may be higher depending on additional sales tax levied by individual municipalities.

. This page describes the taxability of. North Carolina has recent rate changes Fri. State Sales Tax The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in.

If you are looking for additional detail you may wish to utilize the Sales Tax Rate Databases which are provided. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. With local taxes the total sales tax rate is between 6750 and 7500.

There are a total of 458 local tax jurisdictions. Check with the North Carolina Dept of. Certain items have a 7-percent combined general rate and some items have a miscellaneous rate.

Sales tax rates are not uniform across North Carolinas 100 counties. 75 Sales and Use Tax Chart. County and local taxes in most areas bring the sales.

828 rows 697 North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. 31 rows The state sales tax rate in North Carolina is 4750. If you need access to a database of all North.

Click any locality for a full breakdown of local property taxes or visit our North Carolina sales tax calculator to lookup local rates by zip code. North Carolinas general state sales tax rate is 475 percent. In some counties the combined rate of sales tax is as high as 75 while in others that rate is as low as.

Prescription Drugs are exempt from the North Carolina sales tax Counties and cities. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7. Job in Charlotte - Mecklenburg County - NC North Carolina - USA 28202.

Depending on local municipalities the total tax rate can be as high as 75. 2 Food Sales and Use Tax Chart. Job in Boone - Watauga County - NC North Carolina - USA 28607.

The transit and other local rates do not apply to qualifying. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The North Carolina NC state sales tax rate is currently 475.

Cottage Food Sales Tax Understanding The Basics Castiron

North Carolina Sales Tax Update

South Carolina Sales Tax Rates By City County 2022

County Advocacy Hub North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Taxes On Food And Groceries Community Tax

Historical North Carolina Tax Policy Information Ballotpedia

Sales And Use Tax Regulations Article 3

Tax Comparison North Carolina Verses South Carolina

Important Sales Tax Issue For Residents Chatham County Nc

Tax On Restaurant Foods In North Carolina

Sales Tax Laws By State Ultimate Guide For Business Owners

State Sales Tax Rates 2022 Avalara

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

States Without Sales Tax Article

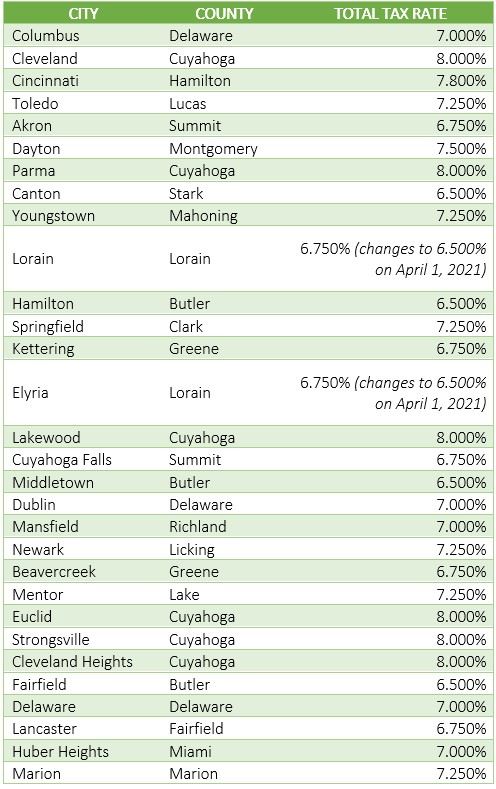

Ohio Sales Tax Guide For Businesses

How To Get A Sales Tax Certificate Of Exemption In North Carolina

North Carolina Sales Tax Rate Table Woosalestax Com